Narrator: Welcome to Blockchain Explained, the podcast about opportunities, challenges, and trends in blockchain technology. Whether you're a beginner or an expert, a developer or just crypto-curious, this podcast is for you. It features industry leaders and government officials discussing the world of distributed ledgers, cryptocurrencies, and the metaverse. And now, here are your hosts, Alan Rechtschaffen and Kellee Wicker.

Kellee Wicker: Welcome back to Blockchain Explained. In this episode, we'll be having a special conversation with me, Kellee Wicker, Director of the Science and Technology Innovation Program at the Wilson Center, and my co-host, Alan Rechtschaffen, Wilson Center Trustee and Chair of the Digital Assets Forum. Alan, I'm going to let you take it away.

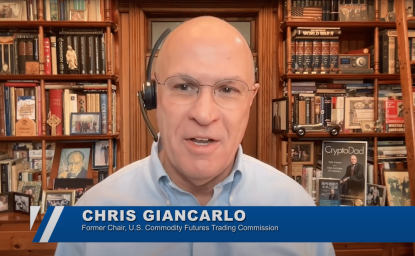

Alan Rechtschaffen: Sure. Kelly, you know, I really appreciate these opportunities where you and I just talk with each other about what's going on. We did one at the end of last year and, I appreciate being able to do this today. And I think it's a great opportunity for us to share some of the information flow that we're getting sitting in Washington. Look, the Wilson Center, is a place where you get unbiased information. We are extremely nonpartisan, whatever that means to be extremely nonpartisan, but we are. We're very much committed to getting the facts out there, getting the truth about what's going on. And in that regard, we're trusted by the, the house, by the Senate, by the executive branch to, give them information. And I think that some of the information flow that we're getting, I think we should share with our constituents in the podcast. So I want to start out talking about some of the things that we've been hearing in our monthly meetings that we have with industry and, you know, some observations about what's going on. You know, this cryptocurrency market has gone to extreme numbers. I don't want to say extreme because maybe they're going much higher, but the prices have gone way up again. They're partying like it's 2021 again. And I think there's a lot going on. Some of which is motivated by outside forces. Like you have, you know, the SEC approved ETFs in Bitcoin. You have a case that the SEC, won in part and perhaps could be called lost in part, again, the SEC v. Ripple case last year. And this, I think is having some impacts on the market, maybe some beyond what the cases actually tell you, or what the approvals actually tell you about the reality of what's going on. But there's a lot of interest going on. I was hoping that you could start out by sharing some of the things that we're hearing on these monthly calls that we have with industry about why there's this new focus and excitement in the blockchain and cryptocurrency markets.

Kellee Wicker: Yeah, you know, it just seems like a lot of people who are really active in this space, what they're seeing is the development of a lot of new use cases. The industry is maturing. You know, we, like Alan, you and I have always said that crypto is not dead. It's, it's only just now hitting its adolescence. And we're just now finding out how we can leverage this technology, where it can be functional and what to do with it. So there's a lot of really interesting things that we can do that I think are kind of legitimizing the blockchain and technology. For a lot of people, the froth and fraud chased them off. But we're seeing both the rising value on the financial side is bringing people back. Money always helps. But then also the use cases. You know, we've got even things like literally physical infrastructure that's on the chain. That's crazy. There's mobile networks that are blockchain based. There are ways that this technology is touching people's lives that it didn't used to. One thing that I think though is kind of interesting, on the policy side of things, one thing to really watch is that we can't treat this like a zero-sum game. Some people kind of want to, and I heard, somebody pointed out that this was a technique that Sam Bateman Fried used when he was on the Hill before he went to prison was kind of divide and conquer, like, oh, well, you know, that's Bitcoin, and, you know, they're terrible, and we're great, and we do this. I think it's really important that people who are advocates for this technology being important, being valuable, to realize that all boats rise. We need to talk about the technology, not as a zero sum game. If Bitcoin is doing well, it doesn't mean everything else is doing worse. Everything's doing better. The more people understand it, use it and become less scared of it. You know, there's a temptation sometimes to view it as winners and losers, but the winner is the technology as a whole, and the loser will be if you let it get fractured, in my opinion.

Alan Rechtschaffen: And you know, it's interesting because Bitcoin actually is interesting in terms of its effect on other technologies. Although now people are looking at going beyond just using Bitcoin as a currency, this idea of ordinals, about having things on the Bitcoin chain that go beyond its use just as a digital entry being used as a currency or a storehouse of value. So there's, there are other use cases, but Bitcoin because it's becoming somewhat mainstreamed by getting a lot of attention from the media after the SEC's look at the ETFs, which is no endorsement of the ETFs, but just says that they're accessible to people who they were not accessible before, it becomes something that mainstreams it. And one of the things that we constantly are talking about with the various blockchains that meet with us on a monthly basis with the industry that we talk to is that adoption of this is hinged a lot on people changing their behavior patterns. People looking to a different technology requires a different look at the way things function. The legitimatizing in people's minds of the technology by virtue of what's happening in the cryptocurrency markets is certainly helpful in the great advertisement. So bifurcating the industry into Bitcoin and sort of everything else is interesting because Bitcoin really is designed or initially was designed by Satoshi Nakamoto to be a currency, to be a peer-to-peer currency that is supposed to allow for decentralization, which, you know, puts monetary policy into question and fiat currencies into question. But at the same time, it's brought a lot of attention to a technology that reaches well beyond the use case of Bitcoin as a currency.

Kellee Wicker: Yeah, I can't even touch the monetary policy side of things. That's your, that's your domain. It's above me. But, yeah, I think, you know, Bitcoin will always be the OG. It'll be the first thing people really hear about. It'll be how a lot of them enter. But you know, so our researcher, Jared, who had, was on a previous episode of this show, one thing that he's really excited about is that Ethereum is about to push some new upgrades. It's going to increase transaction speed. It's going to decrease costs. It's going to make a lot of things possible that previously weren't because of just, the high barriers. But I think to your point, one of the key barriers to people's adoption of this isn't necessarily the money or the speed. It's the user-friendliness. Sometimes, this stuff is really difficult to penetrate. But it seems like we're heading in a really good direction on that. People are finally having some kind of interface that makes sense and on the financial side, it seems like the ETF is a good example of that. There's other examples on the non-financial uses of this where it's becoming easier to start playing a little bit.

Alan Rechtschaffen: One of the other things is the usability question. That's one aspect of it. But, you know, we've had people on the show who have been using, collectibles, you know, NFTs as collectibles. We had somebody from Mattel and we talked about Barbie and collectibles, using NFTs. But one of the things that's out there and that grappled with by our constituents on the Hill is that mainstream corporations need regulatory clarity on how these things are regulated. There was, there's an idea that they have gotten some regulatory clarity from, uh, the SEC versus Ripple case, for instance, but I think I would advise and we'll, we'll link a copy of that case to this podcast, I would advise everybody who's watching this to read that case, read the decision, read how the judge limited that decision in that case to the facts of that case. So I think there's still is a lot of regulatory uncertainty. No matter what cryptos currency you've talked about, there is no assurances that the SEC will not state that they are a security at some point and that's particularly important when you're deciding to implement a technology that's reliant on a currency that is the motor or the gas of that technology but could one day be determined to be a security and the determination is just a matter of the SEC saying this is a security, you know, we can adjudicate it later, whether the court agrees with them, but when the SEC makes that statement, this is a security and then tries to bring it under the umbrella of security law, that prospect does have a chilling effect on implementation because you know, if I'm a decision maker and cryptocurrency has its history and the vagaries of cryptocurrency, even if it's becoming sort of mainstream-ish, without regulatory certainty, without clarity, it really hampers the industry's ability to grow. And one of the things that we found in. And every month that we've been speaking with industry about this is their desire to get regulatory clarity. They are not against regulation. They are proponents for the most part. Maybe they're just, you know, talking their book, but they are proponents for having regulatory clarity as opposed to having it be some version of the Wild West.

Kellee Wicker: Yeah, and you know, it's an election year though. Do you think we can pull it off this year? Or are we gonna have to wait till 2025.

Alan Rechtschaffen: I think it's particularly interesting, you know, to hear what the two candidates for the highest office in the land say about cryptocurrency. There is a Senate race, with Elizabeth Warren. That's particularly interesting because cryptocurrency. And Elizabeth Warren has made very clear what her position is on cryptocurrency, and I'll refer our audience to look that up themselves without my trying to encapsulate it here. But I think that it is an issue that will be impactful in November on the highest election and on other elections throughout the country. Whether we can reach any clarity by November or by December, that's a whole other question. And, beyond the scope of our ability to understand monetary policy or cryptocurrency or blockchain on this podcast, and I'll leave that to the political pundits to figure that out.

Kellee Wicker: Well, on that auspicious note, perhaps we should wrap for today.

Alan Rechtschaffen: Yeah, and we should, we're going to do this more often, sort of give you, our viewers and our listeners, an update on what we're hearing from industry, what we're hearing from the Hill. There's a lot of hope in the industry, um, with several bills that are moving their way through Congress. And there is also a reality check of this being an election year. So stay tuned.

Kellee Wicker: Yeah. Thanks, Alan. As always.

Alan Rechtschaffen: Kellee, always great to be with you. Until next time.

Narrator: Thanks for listening to another episode of Blockchain Explained. Please note, nothing in this podcast should be construed as investment advice. Want more clear-eyed analysis of this exciting technology? Search for Digital Assets Forum at the Wilson Center for research, event recordings, and more. Want to ask our hosts a question? Write to STIP, S-T-I-P, at wilsoncenter.org with your thoughts. Thanks again, and we'll see you next time on Blockchain Explained.